Internet entrepreneurial adventures and competitive rowing are just a couple of things Tyler and Cameron Winklevoss have conquered. Well, and that $65 million settlement from Mark Zuckerberg, as the pair claimed he stole their ConnectU idea and turned into the largest social media platform in history. A couple years ago, the eclectic twins claimed they owned about 1 percent of the total existence of bitcoin. They launched a filing for a bitcoin exchange in 2013 and have big plans that have many bitcoin users shaking their head.

The exchange will obviously be called Gemini. The exchange will be regulated and potentially FDIC insured (this is still questionable), claims the twins.

Reportedly, they have sealed a deal with a New York chartered bank and have all their ducks lined in a row to start the process. They assure they simply want regulation to avoid any movements by underground criminals or terrorists. Other bitcoin companies have flown the U.S. coup for other countries, following a hint of forced regulations. In a blog post dated this past Friday, Cameron pens why the twins have decided to embrace the idea of the fully regulated bitcoin exchange.

The twins tout an American link to bitcoin, but what most avid and long-time bitcoin users see is government regulations, red tape and corporate greed.

When regulation is tied into it, what will bitcoin officially become? Debates on money, crypto-currency, virtual currency and decentralization have surrounded bitcoin since it made its way from the quiet tendrils of the Internet. Even judges are conflicted when it comes to identifying bitcoin, and how it should be resolved in legal matters.

Will regulations cure the issues seen when bitcoin comes into public forum and court cases? The IRS calls bitcoin “convertible” virtual currency, due to its ability to convert between users into money. There is also a tax connected to it, under Publication Notice 2014-21 Section 3 from the IRS, but when filing it for federal tax purposes? The government taxes it as a property.

Confused yet?

The regulations and government interference is what many long-time bitcoin users have long avoided. They have skimmed along the surface of legalities when it came to the digital currency.

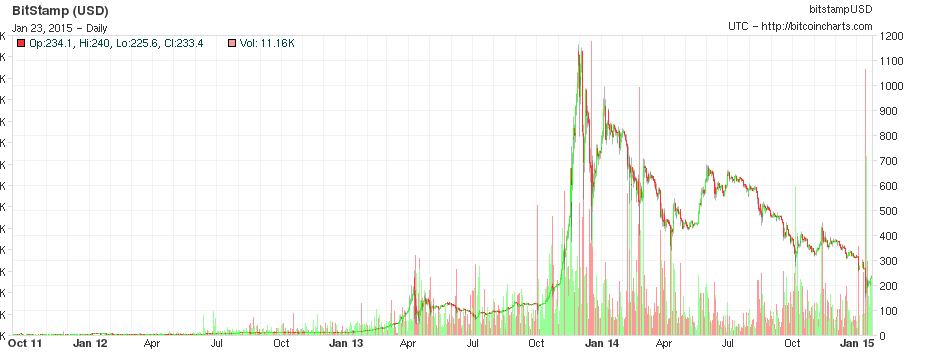

The plans in place by the Winklevoss twins can blow any gray areas from the water, and push forward new regulations that will turn the bitcoin industry on its head. While bitcoin reached its peak in 2013, once it became popularly known, it has maintained a pretty steady downward trend. Plus, bitcoin has shown its vulnerability, especially following the massive Mt. Gox loss which pushed the company into bankruptcy following a security breach.

Bitcoin’s identity has never linked it to a leash by a single group or entity, but it appears that is exactly what the Winklevoss twins have in mind.