As the tax season ended back in April, millions of businesses requested a September extension of their federal tax filing. There are also thousands of businesses that are simply ignoring what they have to do: file taxes. Instead the companies collect their funds, spend and fail to pay or file taxes that they know are legally due. Over time, tax fraud can lead to tax evasion, which is associated with criminal penalties. A Taxation graduate, Silvia Chung, recently explained how to avoid this nightmare. She discussed the implications of companies failing to properly adhere to tax law.

Tax fraud and civil penalties

There is a difference between tax fraud and tax evasion, but consistency is also considered over time. Much too often, companies “forget” to file taxes, knowing they must. Many can be, what we call, tax protesters; this does not excuse the fact a company owes outstanding taxes.

Under Title 26, a company can be assessed with civil violations. Many times if the federal tax is not adhered to, the state is not adhered to either. There are circumstances where the state Department of Taxation can place a lock on the business. Companies can usually file and meet the needs for the IRS, but also what they are willing to pay matters.

Under Title 26, a company can be assessed with civil violations. Many times if the federal tax is not adhered to, the state is not adhered to either. There are circumstances where the state Department of Taxation can place a lock on the business. Companies can usually file and meet the needs for the IRS, but also what they are willing to pay matters.

Tax evasion and criminal penalties

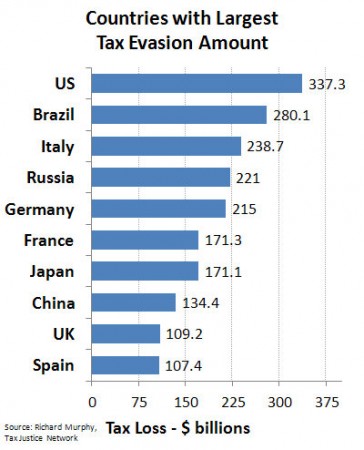

Tax evasion is a part of the whole that is tax fraud. Evasion is a violation of 26 USC § 7201. It can encompass several meanings: a company withheld income purposely when they filed, they exaggerated deductions and they failed to file tax returns to avoid tax detection. Many of these charges, when purposeful and persistent, can lead to the following punishments:

- Imprisonment of between one and five years

- A fine between $200,000 and $500,000, not including the tax due

- Both of these fines may be issued based on the severity of the evasion

Find a strong CPA to avoid whistleblowers

It is best to spend the extra money on a great CPA, and place your trust and updates with them to stay legal. Money spent now will be far less than fines, penalties and a business facing bad, public press. Additionally, for companies with numerous employees and contractors, the IRS has the Whistleblower Program.

They will pay a reward to any person who provides information on underpayment or fraud. To avoid a smeared reputation, a loss of business and criminal charges - it is worth the company taking the time to file taxes and set up a payment plan.